Why Bitcoin is unique

The internet has changed the world. Barriers to global communication and the exchange of information have been reduced to almost nothing. Bitcoin adds another important dimension to this and brings us a natively digital method for storing and transfering value.

It’s money, but digital

The economic definition of money typically involves three specific functions (medium of exchange, unit of account, store of value) and five properties (durability, portability, fungibility, scarcity, divisibility, recognizability). Although bitcoin is a new breed of money, it still satisfies all of these requirements. Instead of relying on physical properties (like gold and silver) or trust in central authorities (like traditional currencies), bitcoin relies on a network of thousands of computers to enforce its mathematically defined ruleset.

You own it

When we carry cash, we are fully in control of its value. When we purchase something and give the cash away, its gone. Online banking and payments rely on third parties that hold our money for us and allow us to access it through their websites and applications. Bitcoin manages to combine the benefits of cash as a bearer instrument, with the convenience of online banking. When you control your bitcoin private keys, nobody in the world can take your bitcoin.

Global by default

Bitcoin can be used by anyone with an internet connection, which is available to around 53.6% of the world population, a number that is growing quickly. Some aspects of bitcoin, like key and address generation, even work without being online. This makes it the first truly globally available form of money that is unbound by country borders. People from around the world can freely transact without having to rely on middlemen like currency exchanges and local payment services.

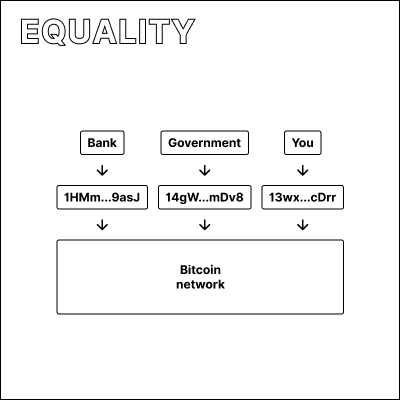

All participants are treated equally

Bitcoin as a technical protocol relies on addresses and does not work with concepts of persons, real-life identities or even user names. Individuals, companies, governments and anyone else interact with it on a level playing field with the same rights and benefits. At a fundamental level no group can shut another group out and censor transactions or confiscate bitcoin. This naturally only applies to bitcoin itself and services built on bitcoin may enforce identity verification and discriminate between users.

It complements existing financial systems

Around 1.7 billion adults do not have access to banking services, including roughly 55 million US citizens. Reasons may include that lack of availability of financial services, lack of trustworthy institutions, or exclusion of certain parts of the population due to their legal, social or financial status. Bitcoin has the potential to serve these individuals, as it is an unbiased, open, and public network. This can be an incredibly equalizing force for many people and use cases and opens up new economic opportunities.

It is open-source

How many currencies and payment networks allow anyone to just show up, participate and contribute? This has traditionally not been possible since those systems rely on central authorities to function. Bitcoin relies on thousands of volunteer contributors to collaboratively keep the system running, evolve it, and build services on top of it. This community of passionate contributors creates the free software that keeps bitcoin running and allows everyone else to interact with it as they desire.

Continue on and find out why you should design for bitcoin.